Highest mortgage rate for bad credit

Being late on an auto loan payment by a few days or weeks may result in a late fee but the consequences get more severe once you hit the 30-day mark. Four weeks ago the rate was 559 percent.

Trustlink Mortgage Broker Plano Tx Mortgage Lenders Mortgage Brokers Va Loan

Heres what to know.

. But youll likely find many lenders using 43 as the highest DTI ratio theyll allow for a qualified mortgage. Mortgage lending is a major sector finance in the United States and many of the guidelines that loans must meet are suited to satisfy investors and mortgage insurersMortgages are debt securities and can be conveyed and assigned freely to other holders. Mortgage rates jumped again this week hitting the highest levels in almost 14 years and pushing even more would-be buyers out of the market.

Average long-term US. 5 Best Cash Back Credit Cards. Credible makes getting a mortgage easy.

About 16 million homeowners who sought Covid-19 relief through the governments mortgage forbearance program will soon exit with 850000 exiting in the first wave now through October. In the US the Federal government created several programs or government sponsored. If you would like to pay off your mortgage sooner than planned please contact us on 0345 30 20 190 Relay UK - 18001 0345 30 20 190.

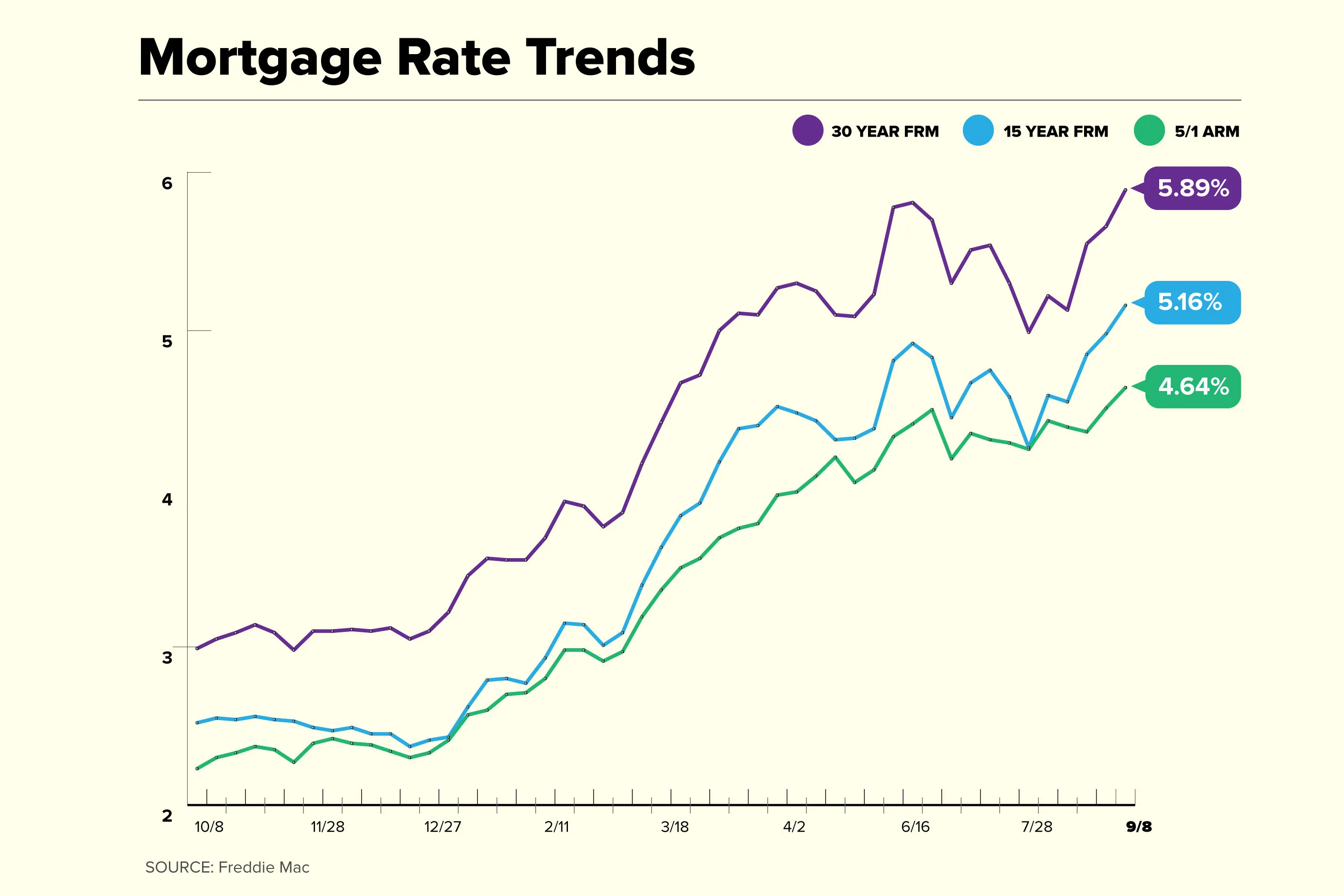

To get perfect credit or close to it a consumer must pay all bills on time have a mix of loanssuch as auto mortgage and credit cardshave paid off most of these loans excluding a. We keep your data private. Mortgage buyer Freddie Mac reported Thursday that the 30-year rate jumped to 589 from 566 last week.

Determine your risk tolerance. The mortgages are aggregated and sold to a group of individuals a government agency or investment bank that securitizes or packages the loans together into a security that investors can buyBonds securitizing mortgages are usually. Those with the highest overall scores are considered the best lenders.

Best Rewards Credit Cards. Best Credit Cards For Bad Credit. A year ago the benchmark 30-year fixed-rate mortgage was 305 percent.

Just enter the amount you want to borrow the value of your home your current monthly mortgage payment existing mortgage balance and. A modern approach to mortgages. The average 30-year fixed mortgage rate rose from around 3 in December 2021 to 589 currently according to Freddie Mac.

Rising interest rates in part a result of the Federal Reserves aggressive. This is the third straight week of increases following a seesawing rate that carried through the better part of. Through a Wells Fargo Home Mortgage refinancing loan you may be able to pay off your mortgage sooner cut your higher interest rate lower your monthly payments or convert to a fixed mortgage rate.

The Fed cut interest rates by a quarter of a percentage point three times in 2019 in what Powell called a mid-cycle adjustment In plain English the Fed was easing rates midway through the. Which is the highest that rate has reached since 2008. The rate on the 30-year fixed mortgage slipped to 499 from 53 the week prior according to Freddie Mac.

Mortgage rates close in on 6 highest since 2008. The banks loan officer group offers home equity loans and home equity lines of credit based on the value of your home compared to your existing mortgage balance. It only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter without affecting your credit.

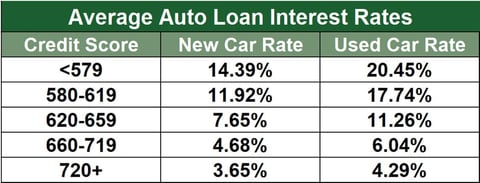

A mortgage-backed security MBS is a type of asset-backed security an instrument which is secured by a mortgage or collection of mortgages. The average rate on a 30-year fixed-rate mortgage is now 589. Lenders check credit scores such as a FICO Score to gauge your overall creditworthiness and delinquent payments can make it harder to secure financing in the future.

Generally rates are highest at online banks but its possible for a brick-and-mortar bank or a credit union to offer competitive yields. Compare rates from multiple lenders without your data being sold or getting spammed. The 30-year fixed-rate average for this week is 299 percentage points higher.

The loan can be used to repair or maintain your home or to renovate or remodel it. Wells Fargo Home Mortgage has online mortgage calculators to help you determine how much of a home equity loan you qualify for. Best Credit Card Deals.

If we do reduce your monthly payments the term of your mortgage will stay the same and you will pay off your mortgage in the same amount of time. A home equity line of credit with bad credit may be possible but bad credit HELOCs can be costly. According to the Consumer Financial Protection Bureau studies have shown that borrowers.

How Credit Score Affects Your Mortgage Rate Nerdwallet

How Your Credit Score Affects Your Mortgage Rates Forbes Advisor

5 Ways To Boost Your Credit Score Improve Your Credit Score Home Improvement Loans Credit Score

Analysis America S Highest Earning State Probably Isn T The One You Would Expect The Washington Post Payday Loans Online Loans For Bad Credit Fast Cash Loans

Minimum Credit Scores For Fha Loans

9 No Money Down Loans For Bad Credit 2022 Badcredit Org

Pin Page

How To Buy A House With Bad Credit Nerdwallet

Companies Owned By The 16 Largest Private Equity Firms Have Weaker Credit Than Spec Grade Companies Not Owned By Bad Credit Mortgage Improve Credit Bad Credit

Can You Still Get A Mortgage With Bad Credit Realtybiznews Real Estate News Bad Credit Mortgage Mortgage Tips

An Outline Of The Basic Tips For Getting A Mortgage And Streamlining The Loan Process Loans For Bad Credit Mortgage Preapproved Mortgage

Pin On Finance Budgeting

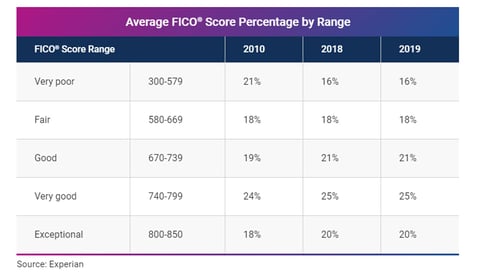

How Many Americans Have Bad Credit 2022 Badcredit Org

Agbo5fvxuoyi1m

How To Buy A House With Bad Credit American Financing

Home Equity Loans Mortgages For Bad Credit Self Employed Bad Credit Mortgage Mortgage Loans Mortgage Rates

What Credit Score Do You Need To Buy A Home Credit Score No Credit Loans Bad Credit Score